Retail Market Development and the Rise of “Regional Retailers”

Management in “AEC(ASEAN Economic Community)Era”

-Retail Market Development and the Rise of “Regional Retailers” -

This discussion series analyzes the effects of the ASEAN Economic Community (AEC) to be formed by the end of 2015. This paper particularly examines the development of the retail industry in ASEAN and the potential impacts from AEC. When it comes to selling consumer goods such as food and beverage products, in many ASEAN countries, the primary distribution channel is the retail shops. The changes that take place in such retailing markets would affect many B-to-C businesses and they come from the external environment. Additionally, the economic development of the ASEAN region and the formation of AEC would bring about significant transformations. Many companies face the challenges and question: Can we grow using these drastic changes as opportunities? OR will we miss the opportunities and lose?

What is ASEAN Economic Community (AEC)?

AEC is a framework with an aim to “transform ASEAN into a stable, prosperous, and highly competitive region with equitable economic development, and reduced poverty and socio-economic disparities” (ASEAN Vision 2020).

The four key characteristics that the AEC envisages are: (a) a single market and production base, (b) a highly competitive economic region, (c) a region of equitable economic development, and (d) a region fully integrated into the global economy. In achieving (a) a single market and production base, there are five pillars: (i) free flow of goods; (ii) free flow of services; (iii) free flow of investment; (iv) freer flow of capital; and (v) free flow of skilled labor.

■ The Impact of AEC Blueprint on the Retail Industry

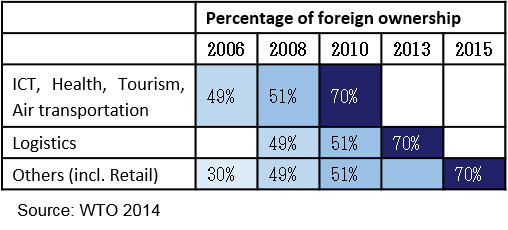

The “free flow of services” regime has significant impacts on the retail industry. According to Chart 1, in each ASEAN country, the regulation barriers on foreign ownership are lowering. Particularly for the retail industry, the percentage of foreign ownership is relaxed to 70% by 2015.

Consequently, local as well as international retailers in the ASEAN region can expand their businesses more aggressively in the region.

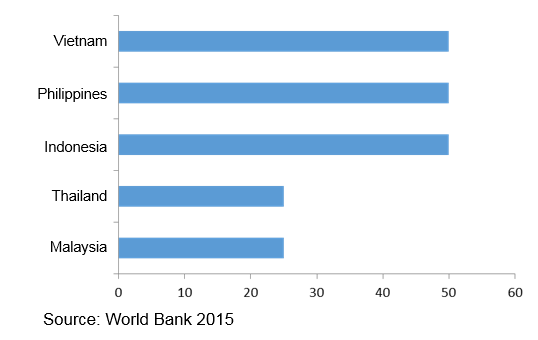

However, the regulations on the percentage of foreign ownership are not the only issue. The barriers on (formal and informal) market entry still exist: the regulations on real estate acquisition, number of stores, goods and products that a retailer can sell. Thus, according to the Service Trade Restriction Index published by World Bank, Vietnam, Indonesia and the Philippines have the strictest restrictions towards foreign investment in the region.

【Chart 1:Progress on the Implementation of Free Flow of Services】

【Chart 2:Service Trade Restrictions Index of the Retail Industry 】

■ An Overview of the Retail Market in the ASEAN Countries Market Size

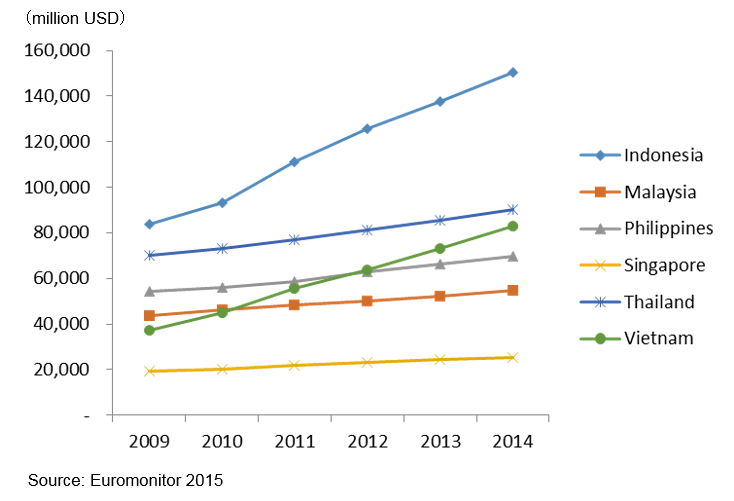

The overall market size and trend in Chart 3 is to establish a premise for the discussion. The market size is mainly defined by the country’s population and economic level. Being the country with the largest population in the region, Indonesia has a total market size of over USD 150 billion. One of the “late-comers” to join the ASEAN community, Vietnam, also sees very rapid market growth.

【Chart 3:ASEAN retail market size and trend】

Modern Trade and Traditional Trade

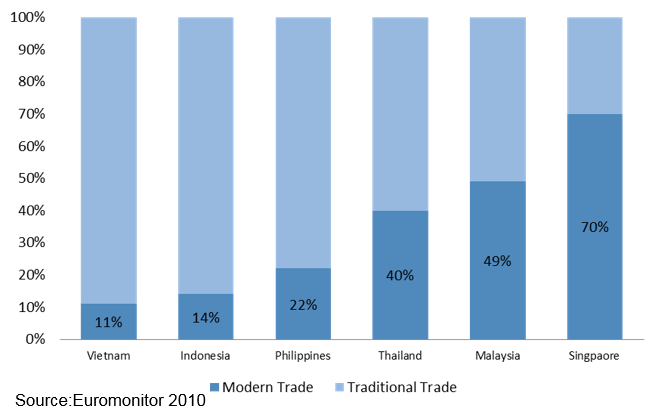

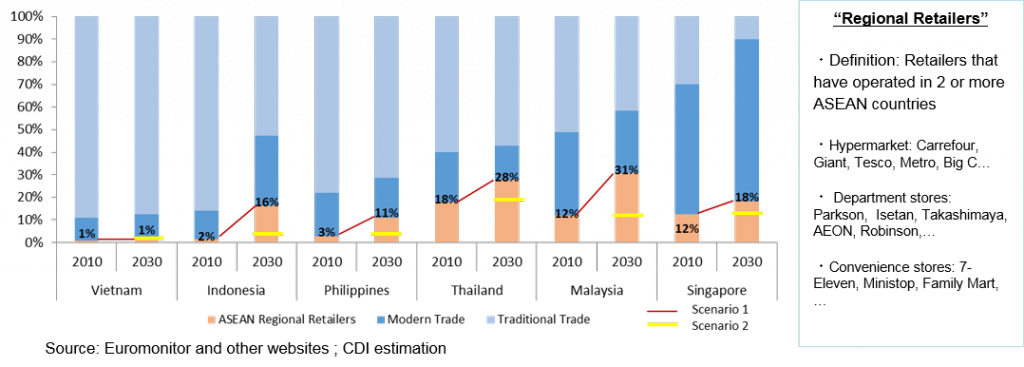

In an emerging market like ASEAN, the ratio of traditional trade is typically high. In other words, wet markets or family-run small size stores still account for the majority of share in the retail market. Except for Singapore, other ASEAN countries have a very low ratio of modern trade (Chart 4). Therefore, the ASEAN retail market as a whole has substantial opportunities for modernization.

【Chart 4:Market share of Modern Trade in ASEAN Countries (2010)】

How should the B-to-C businesses that sell goods to end-consumers view the differences between traditional trade and modern trade? In traditional trade, since there is no formal organization, establishing the distribution network to deliver goods to the retail shops is essential. A company has to develop the required capacity and marketing capabilities in-house to establish a network with powerful distribution partners. Moreover, in establishing the distribution network, it is important to consider strengthening the cash collection function. In most traditional retail shops, the shelves are typically narrow and small. Therefore, the space allocated to each product category is limited. To achieve a high market share (in top 3) can also be said to have an “entrance ticket” to the traditional trade.

On the other hand, in modern trade, listing fees, marketing cooperation expenses and other “on-the-spot” fees are the major source of concern. As a result, the profitability in traditional trade is at times higher. The short-term goal for market share and profitability would apparently be to concentrate on traditional trade. However, it is also important to capture the opportunities when modern trade expands in the future. Keeping in mind the time frame of “now” and “in the near future” is necessary in allocating the resources in the organization structure and financing.

■ ASEAN Regional Retailer Competitiveness and Growth

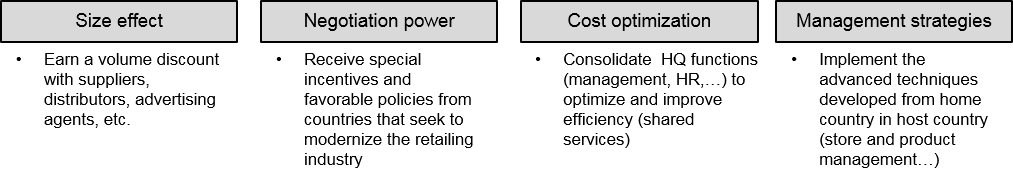

With the economic development and the lowering barriers on foreign investment in the ASEAN countries, many “regional retailers” have been expanding their businesses to several countries in the region. Some of these retailers are international players from outside of the ASEAN region; while some originate within the region. To meet the consumer needs and compete in each local market, the regional retailers may exert the following strengths:

【Chart 5:Regional Retailers’ Strengths】

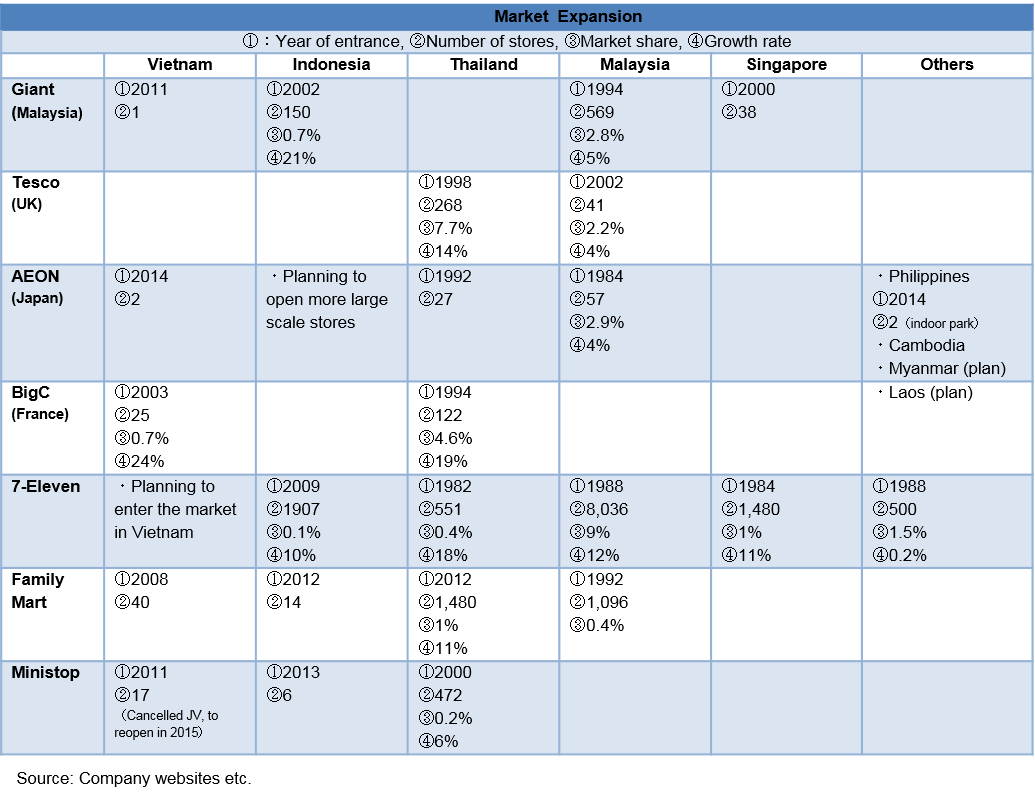

【Chart 6:Market Expansion of the Major Regional Retailers】

■ Retail Market in the “AEC era”

The previous sections review the expansion of modern trade and the growth of the “regional retailers”. This section measures the impact of such changes using the sensitivity analysis. To estimate the growth rate of the regional retailers, two scenarios have been formulated as follows:

– Scenario 1: The average growth rate over the period of 2010-2013 will remain the same until 2030.

– Scenario 2: The ratio of ASEAN regional retailers’ market size to MT retailing will continue until 2030.

【Chart 7:Movement of Modern Trade and Regional Retailers】

■ CDI’s insight

The ASEAN retailing market is in the most critical time of a significant change. B-to-C businesses(*) that have been able to keep a local market share over the years are so slow to adapt to changes that their market share is dropping. Furthermore, these companies are not very concerned about the underlying structural causes for the decreasing trend in their market shares. To be make the first move without missing the sign of the major changes, it is important to continue observing the entire retail industry as well as taking care of the current channels in use.

(*): Case studies are discussed on a separate paper.

CDI Asia Business Unit

Consultant LAM KHANH VAN

Director OGAWA TATSUHIRO

(May 2015)

Download attachments

Download attachments